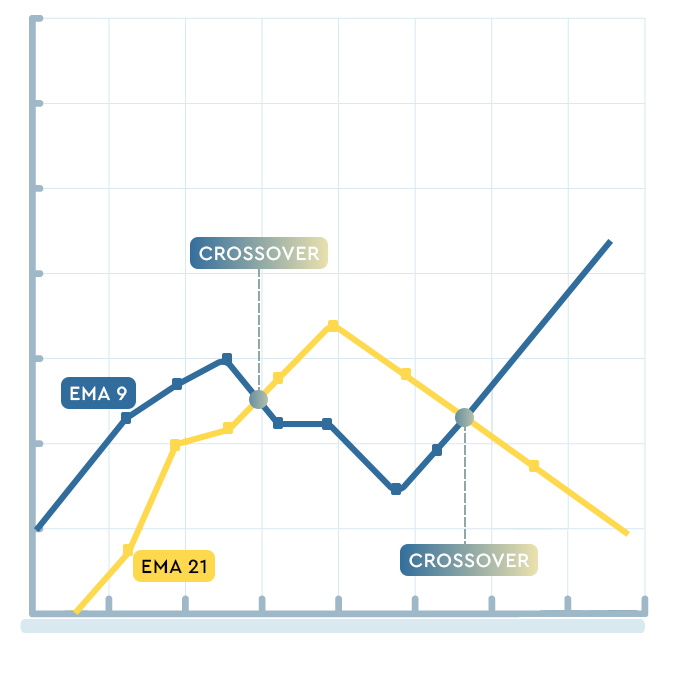

EMA (Exponential Moving Average) and SMA (Simple Moving Average) crossovers are essential concepts in technical analysis.

SMA calculates the average price of an asset over a specified period, providing a smoothed trend line. In SMA crossovers,

short-term SMA crossing above long-term SMA indicates a bullish trend,

while crossing below suggests a bearish trend. EMA, on the other hand,

gives more weight to recent prices, making it more responsive to recent market movements.

EMA crossovers occur when short-term EMA crosses above long-term EMA, signaling potential upward movement,

or when it crosses below, indicating potential downward movement. Traders use these crossovers to identify buying or selling

opportunities in financial markets.

Benefits of Moving Average Crossovers:

A trader may use a shorter-term moving average and a longer

term moving average to identify when the short-term trend is

crossing above or below the long-term trend. This can help the

trader determine when to enter or exit a trade.

If a short-term moving average crosses below a longer-term

moving average, it may indicate a potential downtrend, while

if the short-term moving average crosses above the long-term

moving average, it may indicate a potential uptrend

Moving averages can be used to identify support and

resistance. A popular MA is the 200-day, but other timeframes

can also be used. When a stock price is above its MA, it is

considered to be in a bullish trend. When a stock price is

below its MA, it is considered to be in a bearish trend.

Popular Combinations

Period:

The period can be 1 day, 1 hour, 1 minute, or any other timeframe. The descriptions hold true no matter if you use shorter periods for day trading or longer periods for swing trading.

5-period EMA and 20-period EMA

This is a popular combination of EMAs used to identify

short-term trends and potential entry and exit points for

trades. The 5- period EMA is often used to identify

short-term trends and potential entry points, while the

20-period EMA is used to provide a broader view of the

market and identify longer-term trends.

50-period EMA and 200-period EMA

This is a popular combination of EMAs used to identify

long-term trends in the market. When the 50-period EMA

crosses above the 200-period EMA, it may indicate a

potential uptrend, while when the 50-period EMA crosses

below the 200-period EMA, it may indicate a potential

downtrend.

10-period EMA and 30-period EMA

This is another popular combination of EMAs used to identify

short-term and medium-term trends in the market. The

10-period EMA is often used to identify short-term trends

and potential entry points, while Design Response 2 6 the

30-period EMA is used to provide a broader view of the

market and identify medium-term trends.

5-period EMA and 20-period SMA

Used to identify short-term trends and potential entry and

exit points for trades. The EMA5 is a fast-moving average

that is more responsive to short-term changes in the market,

while the SMA20 is a slower-moving average that provides a

broader view of the market and helps to smooth out price

fluctuations.

9-period EMA and 21-period EMA

The 9-period EMA is often used to identify short-term trends

and potential entry points for trades, while the 21-period

EMA is used to identify longer-term trends and provide a

more comprehensive view of the market.

50-period SMA and 200-period SMA

When the 50-period SMA crosses above the 200- period SMA, it

may indicate a potential long-term uptrend, while when the

50-period SMA crosses below the 200-period SMA, it may

indicate a potential long-term downtrend

20-period SMA and 50-period SMA

Used to identify medium-term trends and potential entry and

exit points for trades. The 20-period SMA is often used to

identify short-term trends, while the 50-period SMA provides

a broader view of the market and helps to smooth out price

fluctuations.

10-period SMA and 30-period SMA

Used to identify short-term and medium-term trends in the

market. The 10-period SMA is often used to identify

short-term trends and potential entry points, while the

30-period SMA provides a broader view of the market and

identifies medium-term trends.