RSI (Relative Strength Index)

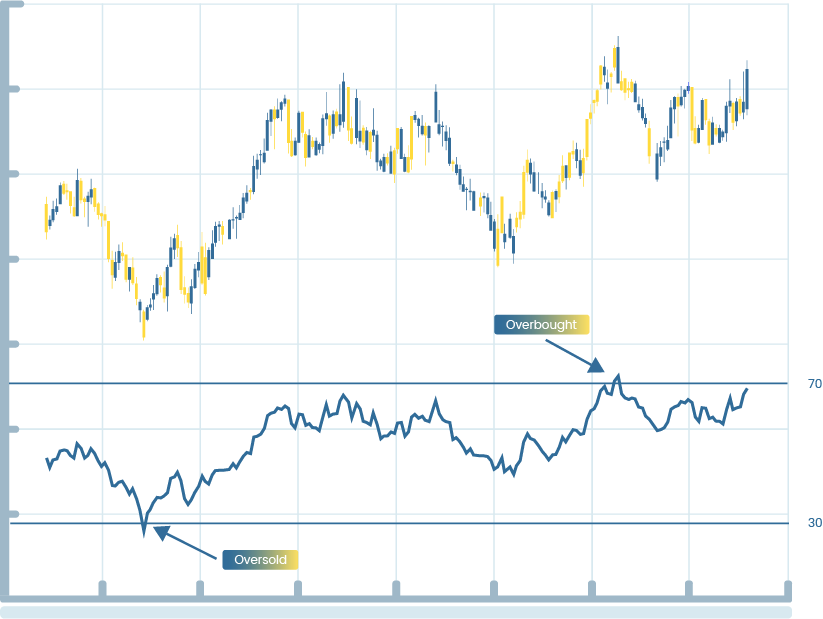

RSI is a momentum oscillator that measures the speed and change of price movements. It's a popular technical indicator used by traders and investors to identify overbought and oversold conditions in a market.

What is RSI?

The Relative Strength Index (RSI) is a numerical value that ranges from 0 to 100. It's calculated using the average of gains and losses over a specified period, often 14 periods, and is used to gauge the strength of price movements. RSI is classified as a momentum oscillator because it quantifies the velocity and magnitude of recent price changes.

How is RSI Used?

1. Overbought and Oversold Conditions:

RSI values above 70 are typically considered overbought, indicating that the asset's price may be due for a correction or reversal. Conversely, RSI values below 30 are often seen as oversold, suggesting a potential buying opportunity.

2. Trend Confirmation:

RSI can be used to confirm the strength of a trend. When RSI moves in the same direction as the price trend, it suggests that the trend is strong and likely to continue. Divergence between RSI and price may signal a weakening trend.

3. Divergence Detection:

RSI divergence occurs when the indicator's direction differs from the price movement. Bullish divergence happens when RSI makes higher lows while prices make lower lows, indicating a potential bullish reversal. Bearish divergence is the opposite.

3. Support and Resistance:

Traders often use RSI to identify potential support and resistance levels. If RSI consistently finds support at a specific level, it can indicate the strength of that support zone.

Popular Timeframes:

1. 1-Hour RSI:

-

Benefit: Shorter timeframes like the 1-hour RSI provide timely signals for day traders and intraday strategies, helping identify short-term trend changes.

2. 1-Day RSI:

-

Benefit:The 1-day RSI is suitable for swing traders and those looking at medium-term trends. It provides signals for position trading and investing decisions.

3. Weekly RSI:

-

Benefit: Weekly RSI is preferred by traders and investors focusing on longer-term trends. It helps identify major trend shifts and investment opportunities.