VWAP

VWAP (Volume Weighted Average Price):

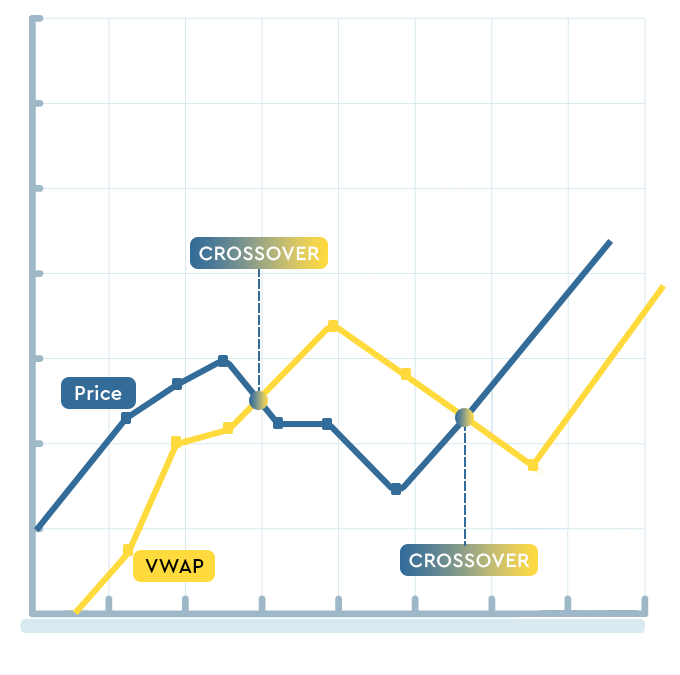

VWAP is a vital trading indicator that calculates the average price of a stock's trades, weighted by the volume of shares traded at each price level. It provides traders with a dynamic reference point to assess intraday trends, volume confirmation, and potential support and resistance levels.

Benefits and Uses:

1. Intraday Trend Identification: VWAP helps traders identify intraday trends by calculating the average price weighted by trading volume. It provides a reference point to gauge whether the current price is above or below the average traded price, aiding in trend recognition.

2. Volume Confirmation: VWAP incorporates trading volume, making it a powerful tool to confirm price movements. When price moves in conjunction with high volume above or below VWAP, it signals stronger price conviction.

3. Risk Management: VWAP can be used for risk management purposes. Traders may set stop-loss levels based on VWAP to limit potential losses or take-profit levels when the price moves significantly away from VWAP.

Popular Timeframes:

1-Minute VWAP:

Benefit: This short-term VWAP provides intraday traders with a very granular view of price and volume dynamics. It's useful for scalpers and day traders who want to make quick decisions based on recent price action.

5-Minute VWAP:

Benefit: Slightly longer than the 1-minute VWAP, this timeframe offers a bit more stability while still capturing intraday trends. It's commonly used by day traders who want a broader perspective without losing the intraday focus.

1-Hour VWAP:

Benefit: The 1-hour VWAP is ideal for traders with a longer time horizon, such as swing traders and some position traders. It helps identify trends and significant price levels over extended trading periods.

1-Day VWAP:

Benefit: Daily VWAP is popular among swing and position traders who make decisions based on multi-day trends. It helps identify long-term support and resistance levels and provides a broader perspective on price movement.